Conet TECH

Continental Network Technologies

Case Studies

Conet-Tech Case Studies

Bank of Montreal (BMO) - Capital Markets

Case Overview

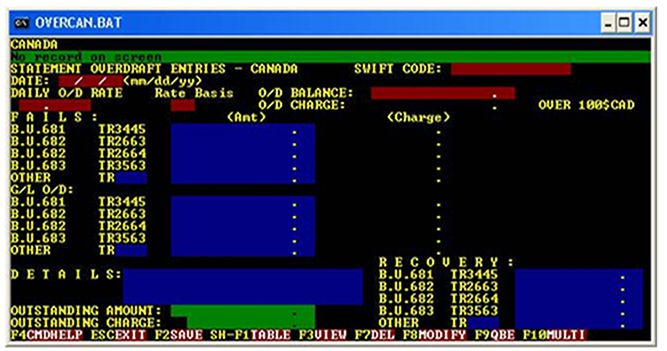

Currently, Cash Reconciliation (CR), Independent Control (IC) of Wholesale Banking Product Operations (WBPO) is using Overdraft Dataease Application (ODA) for Nostro account overdraft charges reconciliation and replenishment. Overdraft charge (OD) including interest is debited to nostro account maintained with BMO correspondent banks. It may be caused by:

- Dealer fails to cover the position

- Expected incoming funds are not received

- Pre-value date payment

- Unauthorized debit

- Dealer is not informed of large/substantial transactions

- Uncleared items

- Incorrect nostro settlement

- Fund paid in error or in duplicate

In some cases charges are credited to it. These unexpected transactions are not able to be reconciled in Intellimatch System (I-Match) and a case will be opened in ITRACS for investigation. Overdraft Officer in Cash Reconciliation will generate, review Overdraft Report from I-Match weekly and start analyzing the charges. Overdraft Officer will also start the process upon receipt of Overdraft statement from Nostro banks.

Customer Overview

Bank of Montreal (BMO) - Capital Markets is a leading, full-service North American-based financial services provider offering equity and debt underwriting, corporate lending and project financing, merger and acquisitions advisory services, securitization, treasury management, market risk management, debt and equity research and institutional sales and trading.Business Challenge

The big challenge was the ability to:- include all existing ODA functions used by the business, like transaction processing, reports and front-end user interface, improve data integrity with SQL server in replacing Dataease, and access security with user role module with IAM compliance and prepare for WBPO Portal

- Integrate Harris and Ireland transactions as part of NODS process flow

- Employ Static data conversion and Cut-over process prior to going Live

Solution

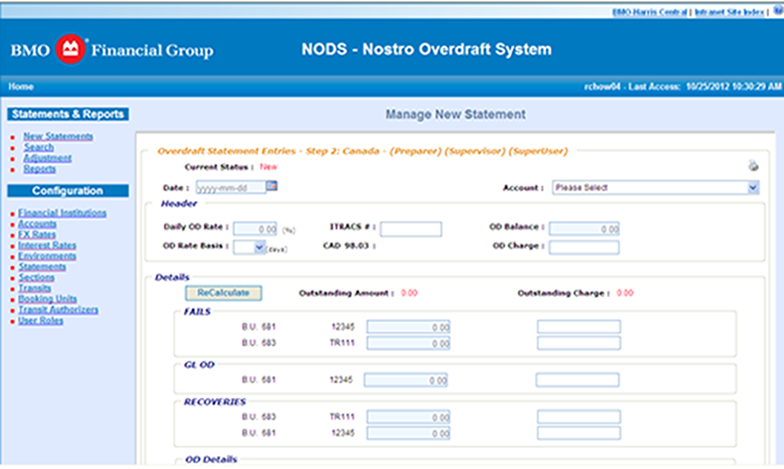

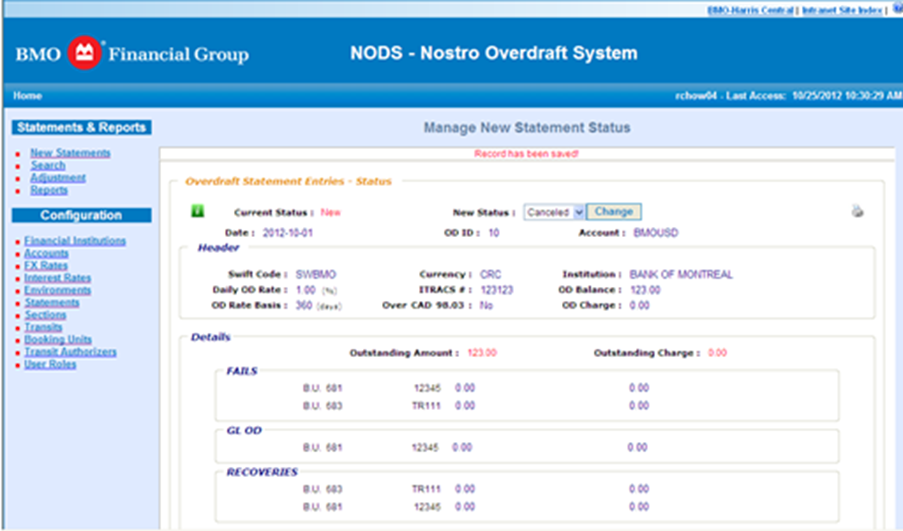

With the help of Conet-Tech, the Nostro Overdraft System (NODS) mission has been redesigned and migrated by replacing the obsolete existing Overdraft Dataease Application. The current system functionality includes Overdraft transaction (OD) Management, Confirmation of OD interest calculation, Investigation of Overdraft (OD) transaction, Authorization of passing accounting entries to square off the nostro entry, and Reporting. The initiative also considers future capability – Phase 2 and future.

The business objectives and/or goals from WBPO strategy perspective are to obtain up to date, scalable, extendible, more robust technology, which includes:

- Reliability – Ensure the application can perform its intended functions

- Maintainability – Minimize the time and cost required to manage the System

- Flexibility – Reduce effort and delivery time required in enhancing the system such as adding new environment like Harris with Marshall & Isley Corporation, Ireland and/or multiple location access

- Compliance – Ensure the system will comply Security – Ensure data entity is conserved and user accessibility is managed as per BMO standard Global Information and Technology Risk Management BMA EOP, SOX 404 Information Technology General Control, and OSFI Business Continuity & Disaster Recovery Requirements

- Security – Ensure data entity is conserved and user accessibility is managed as per BMO standard

- Accountability – Better accountability on user access by authentication and logging

The added value for the client is in the flexible delivery of quality products and services, the automation and simplification of the client’s work processes, data sharing, and last but not least the cost savings.

Results

The overdraft application is mainly used to log all the charges that were applied to the Nostro accounts into one central area. It contains information pertaining to each charge for historical purposes. For example:- The overdraft balance of the account in question

- The number of days the account was overdrawn

- The rate used to calculate the overdraft charge

- The group found to be responsible for the overdraft charge

- The transactions caused the overdraft, if applicable, in details

Since the current application was developed in Dataease, which is a DOS base application. The Dataease development tools and source of the application are no longer exist, i.e. updating or changing the application logic is not possible. Therefore, in order to match with the business and new requirements need, the application was redesigned and rebuilt by Conet-Tech and BMO developers.

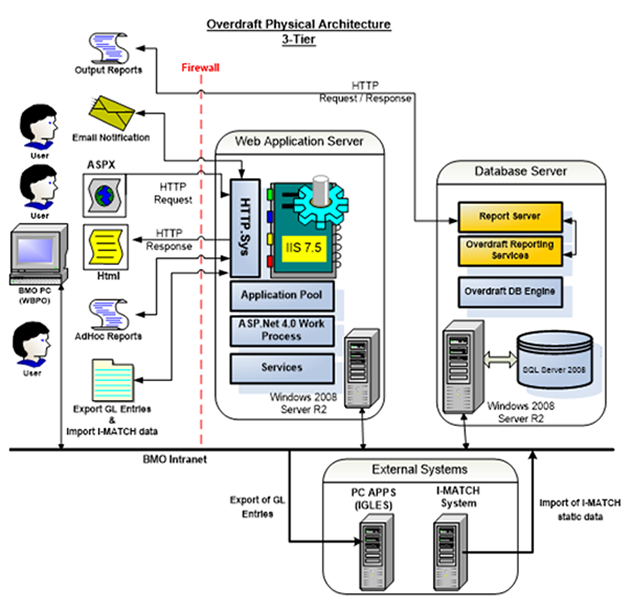

The technologies

- Visual Studio .NET and Microsoft .NET Framework, C#, ASP.Net MVC, HTML5, CSS3- Windows Server and SQL Server Enterprise Manager, IIS, SSRS, ETL, SSIS

- Microsoft Project, TFS, WCF, UML, Visio, AutoSys, Entity Framework