Conet TECH

Continental Network Technologies

Case Studies

Conet-Tech Case Studies

KPMG Canada

Case Overview

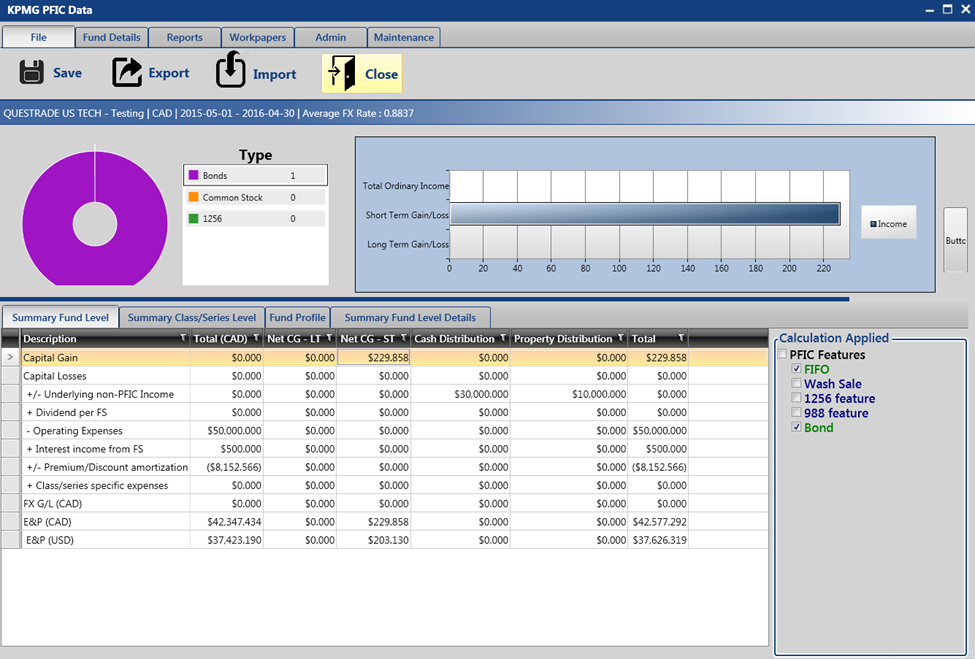

In the beginning, the US Tax department of KPMG Canada was focussed on covering the automated process needs of their client funds and assets. KPMG Canada had seen significant growth in their client base and business transactions were increasing in volume, with no additions to the expert staff for a US fund investor that is a direct or indirect shareholder of a passive foreign investment company (PFIC) that usually files the form 8621; they receive certain direct or indirect distributions from a PFIC, recognize a gain on a direct or indirect disposition of PFIC security such as stock, bond, etc.Conet-Tech started working with the KPMG Canada in 2016 with a pilot project to supply a software solution for management of client portfolios. The growth in the volume of assets and client base forced KPMG Canada to design a new, modern and more efficient system. The project was successfully implemented, and the critical moment when the new system, including integration with the KPMG Canada’s existing client funds, ran smoothly. The implemented solution achieved greater efficiency, meeting the goals that had been set.

Customer Overview

KPMG is at the forefront of an evolving tax landscape. As a leading tax network, KPMG has a duty to engage in the discussion and debate surrounding Tax Transparency and Responsibility. As the tax strategies of multinationals and domestic companies continue to be examined by both tax authorities and the public alike, KPMG works with their clients to develop tax strategies that are fit for purpose in the tax system of tomorrow.KPMG helps with extensive understanding of US and international tax laws and regulations and deep industry knowledge; KPMG's Tax professionals can provide companies with cross border tax advice that goes beyond simple tax compliance to help businesses succeed.

Business Challenge

By default, the US Tax department of KPMG Canada are generally regarded under U.S. tax law as a corporation. As a result of a Canadian investment fund being regarded as a default corporation by the IRS, investors who own Canadian investment funds and who file U.S. tax returns will generally be considered to be holders of a “Passive Foreign Investment Company” (PFIC). Note that all U.S. citizens and green card holders are required to file a U.S. tax return even if they are residents of Canada or another country. Other Canadian residents with significant ties to the U.S. may also be required to file U.S. tax returns.A PFIC is defined under U.S. tax rules. PFIC rules are intended to prevent U.S. taxpayers from securing preferential tax treatment, such as tax deferral, from investing in foreign securities in comparison with U.S. domestic securities.

Calculation

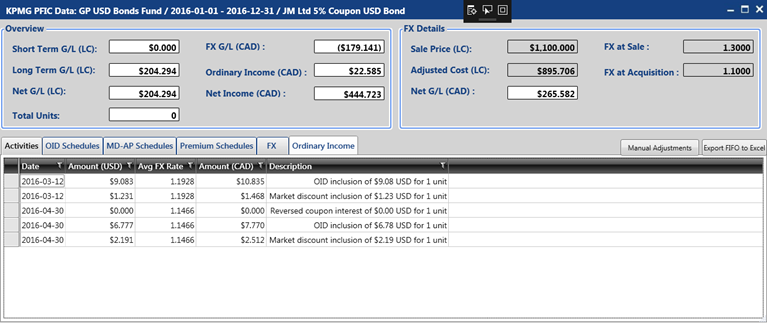

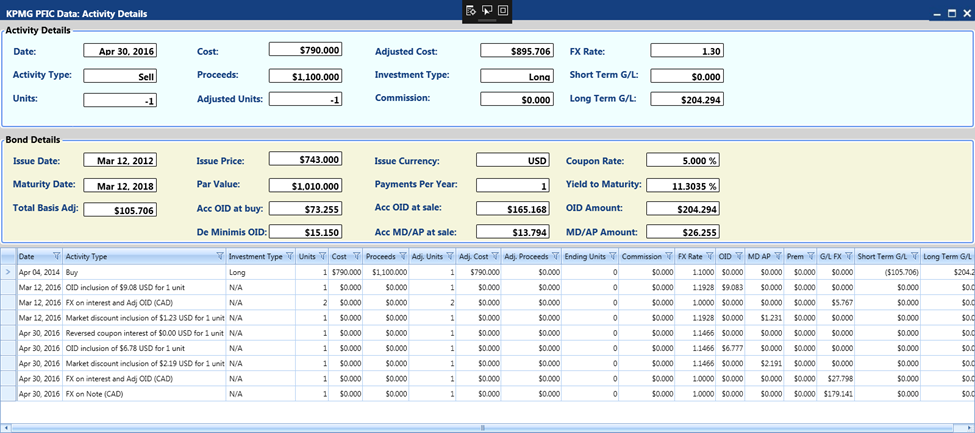

To calculate one’s individual amounts for a QEF election, you will multiply the number of unit days you held the fund (including weekends) by the pro-rata amounts on the AIS.

To calculate the number of unit days, you will multiply the number of units held by the number of days those units were held during the tax year. For example, for an account that held 100 units of a fund for the full year (i.e. 365 days), the number of unit days would be 100 x 365 = 36,500. If those units were held for 180 days, the number of unit days would be 100 x 180 = 18,000. This value would then be multiplied by the pro-rata values on the AIS and reported on IRS Form 8621.

When an investor makes a QEF election for his investment in a PFIC, he should over the lifetime of his investment (from date of purchase to date of disposal) not include in his taxable income any more income (or loss) that he recognizes ‘economically’. For example if an investor purchases 10 units of PFIC A for $20 per unit, and sells them 5 years later at $22 per unit his economic gain is: 10 x (22 - 20) = $20. The amount he should pay tax on is also $20. This should not change if PFIC A is also invested in PFIC B, and the investor makes a QEF election for PFIC B.

Example

Investor purchases 10 units of PFIC A for $20 per unit. PFIC A has 10,000 units outstanding. In PFIC A’s portfolio of investments is PFIC B. PFIC A owns 1,000 units of PFIC B until June 30, when it sold 500 units (at a gain).

In year 1 of Investor’s investment: PFIC A reports Ordinary Earnings of $2 per unit and Net Capital Gains of $3 per unit. It makes no distributions. PFIC B reports Ordinary Earnings of $8 per unit and Net Capital Gain of $4 per unit. It makes a distribution of $3 per unit on July 30.

Investor would include in his US personal tax filings $2 x 10 + $3 x 10 + $8 x (750**/10,000) x 10 + $4 x ((750**/10,000) x 10) = $20 + $30 + $6 + $3 = $61. However since PFIC B made a distribution to PFIC A (which was included in PFIC A income) pursuant to IRC 1293(c) Investor may be able to reduce income inclusion by $3 x (500/10,000) x 10 = $1.5. Taxable Includable income is then $59 (rounded).

(**750 represents 1,000 units for ½ year and 500 units for ½ year)

Investor adjusts his tax basis in his investment from $200 to $259.

In year 2 (January 1) investor sells his investment for $22 per unit or $220. Economically he made $20. His tax inclusion for the year is $220 - $259 = a loss of $39. Add that $39 loss to prior year taxable income of $59 represents an overall taxable income of $20 over two year.

Investor may make an election to defer payment of tax until he receives distributions or makes a disposal.

Solution

KPMG Canada has been working with Conet-Tech from the design phase to implementation phase. From the installation of software for the needs of a single US Tax department, the system and services have expanded not only within the KPMG department, but the now also serve the needs of the investment firm affiliated with the KPMG Canada.

The added value for the client is in the flexible delivery of quality products and services, the automation and simplification of the client’s work processes, data sharing, and last but not least the cost savings.

Results

Each year, U.S. taxpayers must report each PFIC that was held for any portion of the tax year on a separate IRS Form 8621. On this form, taxpayers may make the mark-to-market election or the “Qualified Electing Fund” (QEF) election. There are also various supplementary elections that are beyond the scope of these materials. Annual IRS Form 8621 reporting is required for each PFIC that is directly or indirectly held by the investor, regardless of which election is made. However, it should be noted that an investor with indirect exposure through a PFIC to its underlying PFIC(s) may not be required to include in income the distribution from the lower-tier fund pursuent to IRC 1293(c). Under the mark-to-market election, investors report all income and gains (both realized and unrealized) each year. .Under the QEF election, investors report their pro-rata share of the fund’s earned income for U.S. tax purposes. Investors also receive an increase to their tax cost basis in units of the funds, to correspond with amounts included in income under the QEF election.

The technologies

- Visual Studio .NET and .NET Framework, C#, WPF, TFS, Enterprise Library, Telerik- Windows Server and SQL Server Enterprise Manager, Business Intelligence, Analytics

- Microsoft Project, MS Excel for the data dictionary and Visio drawing and diagramming software