Conet TECH

Continental Network Technologies

Case Studies

Conet-Tech Case Studies

Markel Insurance Company of Canada

Case Overview

Markel Insurance is the Canada’s largest and most respected trucking insurer; Markel has been providing continuous service to the country’s trucking industry since 1951. Markel serves only one market – the Canadian trucking industry. To streamline business processes and improve communications with brokers and customers, Markel Insurance re-launched its public Web site in 2004 and launched a Web-enabled broker self-service site in 2006. The application is giving brokers 24/7 access to real-time information about Markel Insurance customers and their multi-faceted insurance policies. Once the system is fully deployed, Markel Insurance expects to reduce annual printing and mailing costs by at least $350,000 and reduce incoming calls to the call centre by 30 per cent. With the right information at their fingertips, brokers can better service the customer – creating a loyal broker community and a more satisfied client base.Customer Overview

Markel serves only one market – the Canadian trucking industry. As Canada’s largest and most respected trucking insurer, we’ve been providing continuous service to the country’s trucking industry since 1951. With our focused expertise, we provide our policyholders and their brokers with unparalleled service and solutions. We want to be more than your insurance company, we want to be your partner in success.The company services 45,000 customers through 250 independent brokers located in five provinces.

Business Challenge

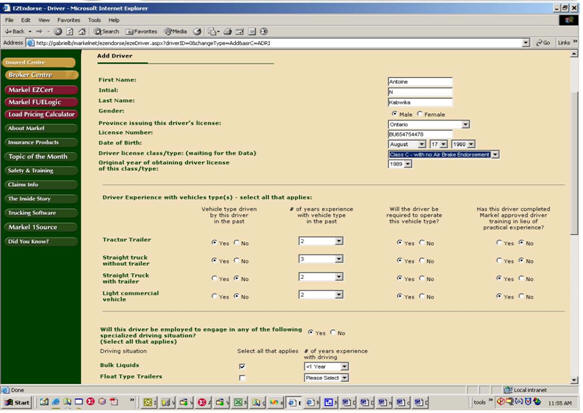

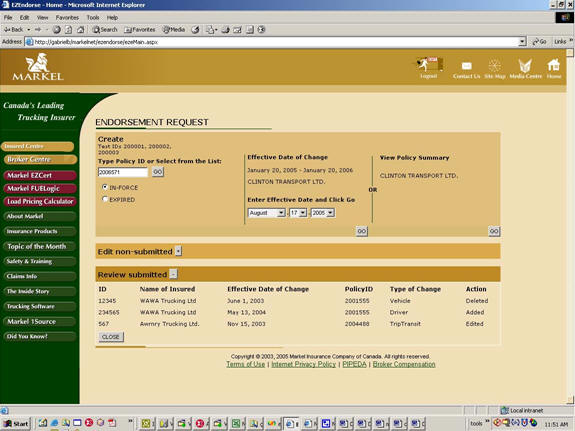

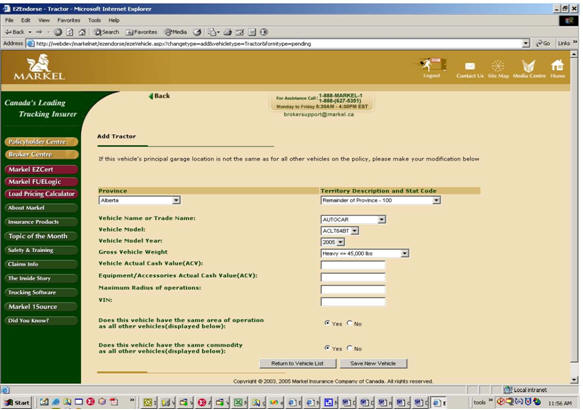

In the past, all customer queries were directed to Markel Canada’s call centre, where a broker could quote new policies, revise policies and verify the latest rates and rules with the help of a Markel Canada representative. Since 30 per cent of calls were straightforward policy queries, it was a time-consuming process that kept customer service representatives away from revenue generating tasks such as revising policies and conducting transactions. Markel Canada knew changes were necessary in order to streamline these processes and improve overall business efficiencies and customer service.Working in conjunction with in-house developers and Conet-Tech, the company relaunched its public Web site (www.markel.ca) in July 2004 as a way to improve communications with customers and brokers. In 2006, Markel Canada also launched a 3 Web-enabled broker self-service site called BrokerCentre, EZEndorse, EZQuote and EZCert for policyholders.

With a password and ID, brokers can view all of their customers’ policies, examine coverage, and access Markel Canada’s private publishing site, detailing the company’s complete rates, rules, contracts, and underwriting guidelines.

After these internet applications went live, the company saw immediate returns on its investment including a significant reduction in printing costs, as well as increased productivity among its customer and accounting service representatives in addition to giving more options to its brokers.

While the company was pleased with the immediate benefits of the two sites, Markel Canada knew it still needed to do more to encourage more brokers to use these sites.

The company also recognized there were a number of internal processes that needed to be streamlined. For example, 65 per cent of Markel Canada’s customers pay their invoices on a monthly basis using preauthorized cheques or credit cards. This, however, created problems for the company when credit cards expired, cheques bounced due to insufficient funds, or had incorrect account information.

When a payment bounces our accounting representative has to call brokers who then have to follow up with clients. These calls are a time-consuming process for the accounting team and brokers who have to follow-up on these accounts on a regular basis.

Adding to the problem was a new policy introduced by credit card companies who were no longer accepting charges to accounts that had expired numbers.

For Markel Canada, this would have been a major problem as it would have increased the number of accounts to follow up on by almost 10 times. Our rejected payments would have increased to almost 17,000 per year. We never used to ask people for updated credit card information, so quite often we didn’t have that information available in our system. Having to update all of these accounts would have been a major undertaking and would have required us to hire more people to handle the volume.

Another issue that needed addressing was related to appraisals made by third-party companies. Markel Canada sends a portion of its appraisals to third-party companies who submit their information to Markel through a variety of formats such as paper or email. Markel Canada representatives then had to manually input this information into its internal system, which was a labour-intensive task and created potential for error.

Another issue with policyholders: for a policyholder to deliver some merchandise, he has to call our call centre in order to prove that his truck is still insured. Our representative has to manually prepare an insurance certificate and fax it.

Results

Thanks to the corporate Web site and Internet Applications, Markel Canada brokers have the tools they need to help improve customer service and boost overall productivity. Enhancements to the site and the new application for third-party companies have also brought efficiencies for Markel Canada including improved employee productivity and cost and time-savings.Prior to the launch of the broker Centre site, Conet-Tech anticipated it would significantly reduce printing and mailing costs and the company will meet its goal.

Markel no longer prints broker contract and rate manuals, broker announcements or broker communications and certificates. They are definitely on par to significantly reduce their paper and mailing costs as they had hoped to do at the start of the project – that is impressive.

Rather than printing and mailing newsletters and other communications, Markel Canada is also using the public Web site to communicate company news to brokers. As well, the company is in the process of stopping the printing of appraisal and policy copies, as brokers can now access this information on the Web site.

Encouraging brokers to use the online services has been a key focus for the company since the launch in 2006. By adding more functionality to the corporate site, Markel Canada is able to offer more value to brokers, by providing them with faster, easier access to updated information they need to conduct business.

Brokers have taken to the changes very well. The more functionality there is on the site, the more reason for a broker to visit every day and the more we see the usage increase. The billing and certificate feature, for example, produced phenomenal results, because it gives brokers a workflow where they have to enter the site at least twice a month. And once they are on the site, they also visit other pages. Increased usage of the site is important to our overall assessment of the site’s success.”

In fact, the company has already seen a significant rise in usage since introducing new features such as EZEndorse and EZQuote. In April 2006, Markel Canada had 57,000 transactions on the broker site. One year later, the number of transactions had risen to 231,000.

The technologies

- Microsoft .NET Framework, C#, ASP.Net, ADO.Net- Windows Server, MySQL, Progress

- IIS, Web Services, MSMQ

Solution

Conet-Tech Consulting Team worked closely with a team of programmers at Markel Canada in several key areas, including helping to define the business requirements, architecting the technical solution, developing the broker and public sites, and overall project management. We defined the user requirements, design the user experience and to assist in identifying business requirements.

These applications (BrokerCentre, EZEndorse and

EZQuote) would need to provide the following

capabilities:

• the ability to provide endorsement and quote

services

• the ability to delegate user management to Markel

Canada brokers, allowing an administrator at each

brokerage to manage their domain of user Ids;

• the ability to authenticate and track users using

high levels of security;

• the ability to manage administrative users for

each broker using a Web-based tool; and,

• the ability to personalize information at a number

of different levels of granularity: based on the

broker and sub-broker, based on the branch and

location of the user and based on the preferred

language of the user.

Security and infrastructure requirements dictated

that the solutions would need to work within a

firewall architecture.

To address the other issues, Markel Canada decided

to add more functionality to its broker self-service

Web site called Broker Centre, in particular, a

billing feature and tool to generate automatically

an insurance certificate.

Added to the site in December 2004, the new billing

feature allows Markel Canada to post a list of

accounts with missed payments or expiring credit

cards on MarkelCanada, which helps to save time and

ensure client information is up-to-date. Brokers can

access all their individual accounts that have a

payment issue, own their own. By the end of February

2005, more than 3,000 updates and corrections were

made by brokers to their customers’ payment

information resulting in fewer missed payments and

better customer service for both Markel brokers and

clients.

Adding this functionality meant that our accounting

department did not need to devote time to this

process, allowing them to focus on more pressing

tasks.

Right now, the broker site is about 70 per cent in

ASP, 30 per cent on ASP.NET, and we’re working on

migrating the rest to ASP.NET. To bring all the

layers together, we’re using Web services – it’s the

only real way we have to communicate between the Web

tier and application server, and from the Web server

to the Web logic components.